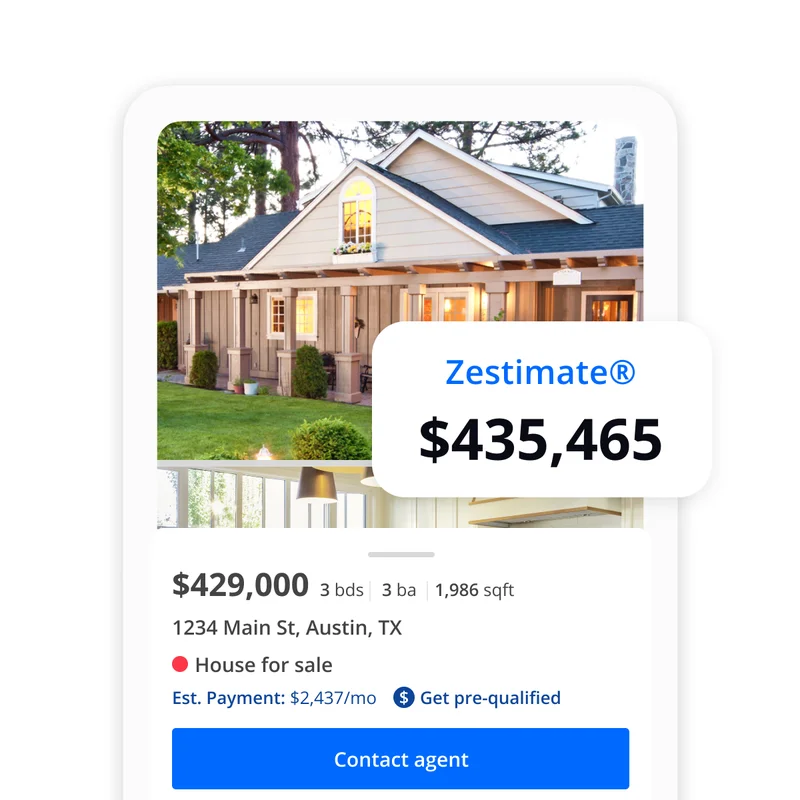

Okay, folks, let's talk about something that's been buzzing in the headlines: Zillow's report that the "hidden costs" of owning a home are hitting nearly $16,000 a year. Sixteen thousand dollars! That's like finding out your spaceship comes with a surprise asteroid-avoidance tax. It sounds scary, right? Headlines are screaming about affordability crises and shrinking demand. But before you start picturing tumbleweeds rolling down Main Street, let’s take a breath and reframe this, because I think we're looking at a massive opportunity here.

See, I think we’re not witnessing the death of homeownership, but its evolution. It’s like when the printing press came along; suddenly, knowledge wasn't just for the elite scribes anymore. It democratized information, and yeah, it shook things up at first. This "hidden cost" revelation is doing the same thing for housing. It’s forcing us to get real about what it actually costs to own a home, not just the mortgage payment.

The report highlights that maintenance is the big kahuna, gobbling up $10,946 of that total. Property taxes and insurance follow, at $3,030 and $2,003 respectively. And, as Kara Ng, Zillow's senior economist, points out, insurance costs are rising faster than incomes. It's a squeeze, no doubt about it.

But here’s the thing: information is power. Now that we know where the money's going, we can start to strategize. Think of it like this: we've been playing a video game on "easy mode," where the game only showed us the initial purchase price. Now, the game's switched to "hard mode," showing us the full cost of ownership. It's tougher, sure, but also way more rewarding if you know how to play.

So, how do we win?

First, knowledge is power, as Zillow themselves suggest. Use those personalized affordability tools! Understand your true buying power. Don't just look at the sticker price; factor in those hidden costs. It's like knowing the cheat codes before you start the level.

Second, embrace preventative maintenance. Thumbtack home expert Morgan Olsen calls it a "safety net for your biggest asset." And he's dead on. A little investment upfront can save you a ton of money down the road. Imagine ignoring that weird noise in your car, and then BOOM, you need a new engine. Same deal with your house.

Third, get smart about the type of home you buy. That sprawling single-family home with the white picket fence might be the American dream, but it also comes with a hefty maintenance bill. Townhomes and condos can be more budget-friendly. Maybe it's time to redefine the dream, folks.

And finally, consider new construction. Yes, it might cost more upfront, but less maintenance in the early years can be a huge win. Plus, new homes often come with warranties that can save you from unexpected repair bills.

This isn't just about saving money. It's about building a more sustainable, resilient, and equitable housing market. It's about empowering homeowners to make informed decisions and take control of their financial futures. It's about creating communities where everyone can thrive, not just survive.

But here's where we need to be careful. This increased transparency also puts more pressure on individuals to navigate a complex system. We need to ensure that resources and support are available to everyone, not just those who can afford financial advisors or fancy apps. We need policies that address the root causes of rising insurance costs and property taxes. It's a shared responsibility, and we need to act like it.

And look at Miami, for example. Insurance premiums there have jumped by a staggering 72% since 2020! That's insane! But it's also a wake-up call. It tells us that we need to adapt to the changing climate and invest in resilient infrastructure. It tells us that we need to find innovative solutions to make insurance more affordable.

Now, some might see all this as a reason to give up on homeownership. But I see it as a challenge. A challenge to be smarter, more creative, and more collaborative. A challenge to build a better future for ourselves and our communities.

I saw a comment on Reddit the other day that really resonated with me. Someone said, "Homeownership isn't a right, it's a responsibility." And I think that's exactly right. It's a responsibility to be informed, to be proactive, and to be engaged.

What does this mean for us? Well, it means we need to shift our mindset. We need to stop thinking of homeownership as a passive investment and start thinking of it as an active partnership. A partnership with our homes, our communities, and our planet.

Time to Level Up Our Thinking

This isn’t a crisis; it’s an opportunity to build a more resilient and equitable future, one home at a time. The game has changed, and it's time to level up.