Okay, folks, buckle up, because the IRS just dropped some news that could seriously change the game for your retirement. Forget doom and gloom – we're talking about real, tangible steps that can help you build a future where you're not just comfortable, but genuinely thriving. The headlines might read "IRS Announces 2026 401(k) Contribution Limits," but I'm here to tell you it's so much more than that. This is about empowerment, about taking control, and about setting yourself up to become a future millionaire.

The Power of Incremental Change

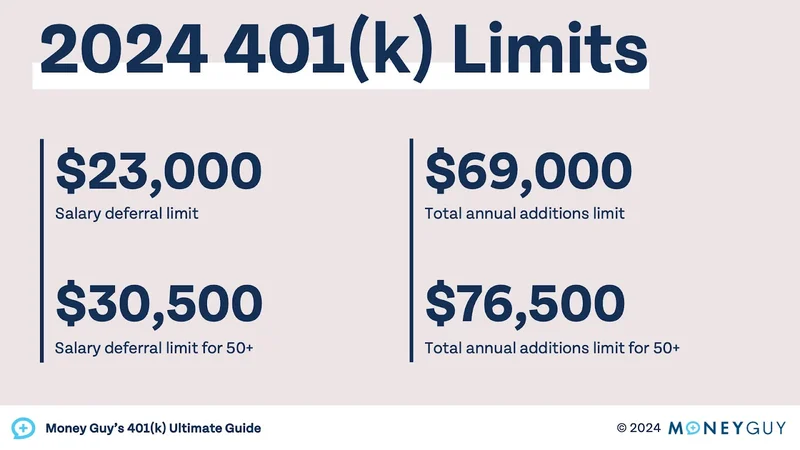

Let's cut to the chase: for 2026, the IRS is upping the 401(k) contribution limit to $24,500, a $1,000 increase. And for those of us playing catch-up (I see you, fellow 50+ crowd!), the limit jumps to $8,000, allowing for a total contribution of $32,500. The IRA limit is also getting a bump to $7,500. Now, I know what some of you might be thinking: "A thousand bucks? That's not going to make me a millionaire!" But hold on a second. It's not about the single increase; it's about the compounding effect of consistently maxing out those contributions year after year. Think of it like this: each extra dollar you save today is like planting a tiny seed that grows into a mighty oak tree over time.

This isn't just about numbers; it's about psychology. It's about the IRS, believe it or not, nudging us to make smarter choices, to prioritize our future selves. It's like they're saying, "Hey, we know things are tough, but we're giving you a little extra breathing room to invest in your dreams." And speaking of dreams, what could you do with an extra few thousand dollars a year in retirement? Travel the world? Start a business? Spend more time with loved ones? The possibilities are endless.

But here's the real kicker, something that gets me genuinely excited: the SECURE 2.0 Act's "super catch-up" provision for those aged 60 to 63. It allows you to contribute even more, up to $11,250! That figure will remain the same for 2026, so workers age 60 to 63 will be able to sock away up to $35,750 next year. When I first read about this, I honestly just sat back in my chair, speechless. It's a game-changer for those late-career savers who need to make up for lost time. What could be more beneficial than taking advantage of retirement options like these? New IRS Rules for 2026 Will Allow You to Contribute More to Your 401(k) and IRA

Now, let’s talk about inflation. Yes, it's been a pain in the you-know-what. But here's a silver lining: the IRS adjusts these contribution limits annually based on inflation. So, while rising prices are hurting our wallets in the short term, they're also leading to higher contribution thresholds, which means we can save even more for the future. It's a bit like turning lemons into lemonade, isn't it?

Of course, with great power comes great responsibility. As we take advantage of these increased contribution limits, we also need to be mindful of where we're investing our money. Are we diversified enough? Are we taking on too much risk? It's crucial to do your homework and consult with a financial advisor to make sure you're on the right track.

I saw one comment on a Reddit thread that perfectly captures the sentiment here: "It's not about getting rich quick; it's about building a solid foundation for the future." That's exactly right. These increased contribution limits are not a lottery ticket; they're a tool, a powerful tool that we can use to create a brighter future for ourselves.

A Future Worth Saving For

So, what does all of this mean? It means that the IRS, in its own bureaucratic way, is giving us a nudge in the right direction. It's reminding us that saving for retirement is not a luxury; it's a necessity. And it's providing us with the tools we need to make it happen.

It's easy to get caught up in the day-to-day grind and forget about the future, but these increased contribution limits are a wake-up call. They're a reminder that we have the power to shape our own destinies, to create a future where we're not just surviving, but thriving. So, let's take advantage of these opportunities, let's max out those contributions, and let's build a future worth saving for. What if you could retire five years earlier? What if you could leave a legacy for your children or grandchildren? These are the questions we should be asking ourselves.